2015: A Year Ripe For Cloud-Based E-Commerce Investment

E-Commerce has grown out of its diapers. In what is still considered a relatively new field, one largely dominated by major players of the 1990s, namely Ebay and Amazon, these powerhouses have now found themselves in a new, fast-growing marketplace. These and other companies, including India’s Flipkart and Snapdeal, understand the need for looking for ways to incorporate cloud-based e-commerce services to help facilitate more effective relationships between merchants and customers. The numbers themselves don’t lie – In 2014 alone, “Over $3.1 billion was pumped into 46 deals in the ecommerce space…”. This staggering amount suggests that 2015 is on target to become a lucrative period for many companies and startups operating within this industry.

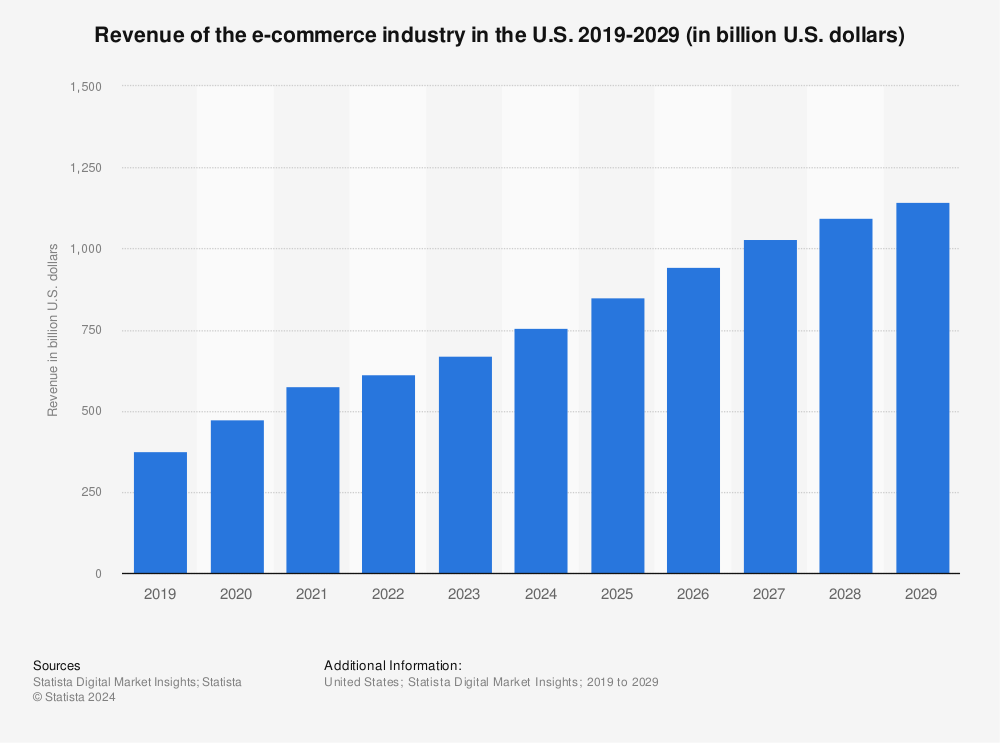

The reasons behind these corporate acquisitions are abundant, as the potential for such services has and will continue to increase exponentially. If we look at the retail industry as an example, according to Internet Retailer, US-based e-commerce “…retail sales are expected to grow from $263 billion in 2013 to $414 billion in 2018.” In dollar growth terms, this rise translates into a nearly 60% growth rate. The chart below from Statista helps visualize some of this data:

Source: Statista.com

Additionally, this growth rate has moved online retail sales ahead of in-store retail purchases, thus marking a significant change in the way customers make buying decisions.

Most notably, e-commerce companies have been making progress in helping to bridge the gap between merchants and consumers. This is predominately the result of a broader trend in the natural evolution of e-commerce, one synonymous with smarter engagement between all parties involved in transactions, and with less dependence on intermediaries. This trend means good news for both shoppers and merchants out there, as the adoption of such products and cloud-based services implies more competitive prices and less dominance by a few large players.

Adding to this e-commerce transition towards more direct relationships between buyers and sellers is the prevalence of real-time deals and similar targeted offers being displayed on consumer screens across a variety of platforms and mediums. This is just another indication of the growing ad tech space. Investors have understood the dependence of brand marketers on these types of platforms, and this year should provide much clarity into new deals and potential M&A opportunities. With spending on digital advertising channels expected to double in the next few years, the value of ad impressions has the potential to elevate relationships within the e-commerce space. This will most likely be the case between buyer and seller, as there is a growing number of cloud-based e-commerce technologies specifically designed to provide the most relevant and personalized deals and offers to digital consumers. Such opportunities have the potential to turn e-commerce marketers into highly relevant advertisers, with the underlying goals of pleasing customers and increasing total revenue via targeted conversions.

As such, investors are already discussing attractive investment opportunities within the realm of personalized digital advertising, where technologies now have the potential to identify ‘hot’ prospects using real-time marketing strategies and on that basis, present relevant offers to maximize their conversion rates. Of course, such advancements in technologies are already (and will continue to be) supplemented by the ability to close deals across a range of different platforms, with a strong emphasis on mobile.

All in all, 2015 should be an interesting year. It will be exciting to watch how the ad tech space will influence both brand marketers and investors operating within the e-commerce industry. Consumers will have the best seat in the house, as their purchase history and onsite activity will force brands and technologies to meet their growing demands for quality products.